Demystifying Non Dilutive Capital: What Every Tech CEO Should Know

by siteadmin

In the world of tech startups, securing the necessary capital to fuel growth and innovation is often a top priority. However, traditional funding routes, such as equity financing, can come at a significant cost – the dilution of ownership and control. That's where non dilutive capital steps in as a compelling and strategic alternative.

Understanding Non Dilutive Capital

Non dilutive capital, often referred to as non dilutive funding, is a form of financing that allows technology companies, particularly startups, to raise capital without relinquishing ownership stakes. It's a lifeline for tech CEOs who want to maintain control of their ventures while accessing the funds needed to drive progress.

The Various Forms of Non Dilutive Capital

Tech CEOs have an array of non dilutive capital options at their disposal, each suited to different stages of a company's growth. These include:

1. Debt Financing: This involves borrowing funds that are to be repaid with interest. Unlike equity financing, debt financing doesn't entail giving away ownership or control of the company.

2. Revenue-Based Funding: In this model, funds are provided in exchange for a percentage of future revenue. It's an appealing option as it doesn't dilute ownership and allows CEOs to retain full control.

3. Crowdfunding: Crowdfunding platforms, like Kickstarter and Indiegogo, enable tech startups to raise funds from a broad audience. It's a non dilutive way to access capital; however, success often depends on reaching a large audience.

4. Grants: Government agencies, non-profit organizations, and foundations offer grants to support research, development, and innovation. Grants are a pure form of non dilutive financing.

Securing Non Dilutive Capital

To secure non dilutive capital successfully, tech companies should have a well-defined strategy and a history of generating steady revenue streams. Demonstrating a sound business model enhances the likelihood of receiving non-dilutive funding.

While tech businesses often look to venture capital and angel investors for financing, non dilutive capital offers a faster and less restrictive way to secure funds. For instance, government grants, tax credits, vouchers, and crowdfunding platforms are popular non dilutive solutions.

Leveraging Non Dilutive Capital for Ownership and Control

Non dilutive financing offers several distinct advantages over traditional funding options. Tech entrepreneurs can maintain full ownership and control of their companies while accessing capital. This means less restrictive terms, fewer expenses compared to loans or equity financing, and the ability to preserve their vision.

Securing non dilutive financing can be challenging, but the effort is worthwhile, especially for tech companies with consistent revenue generation. Thoroughly researching providers based on key criteria can help identify the best match for your business.

Non Dilutive Capital for Short-Term Cash Flow Relief

In the fast-paced world of tech, startups often encounter short-term cash flow challenges that require immediate solutions. Traditional financing options like equity investments may demand giving up ownership. In contrast, non dilutive capital, such as revenue-based financing, allows companies to access the funds they need without relinquishing ownership stakes.

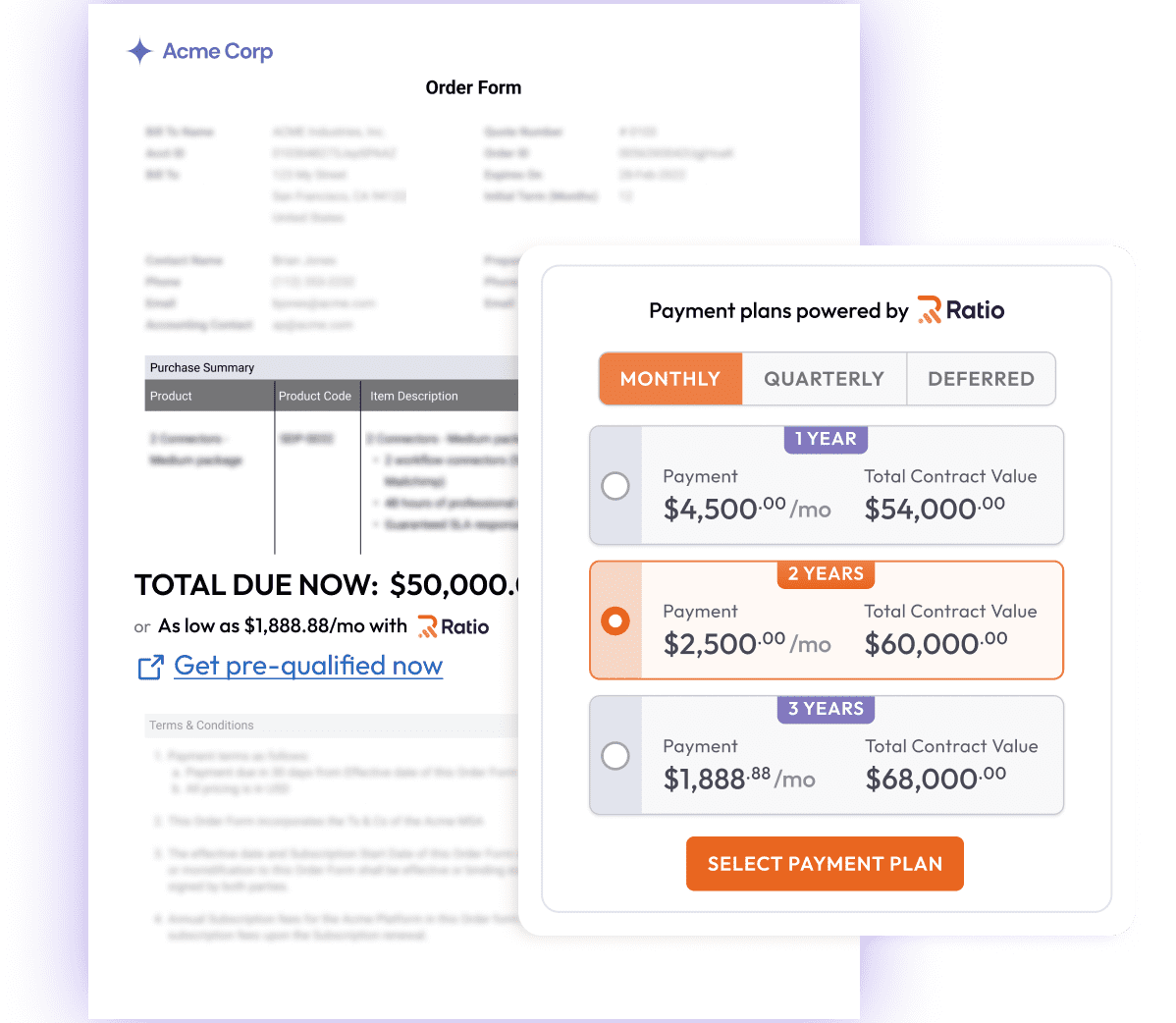

Ratio Tech's Role in Non Dilutive Capital

Ratio Tech, a leading name in tech innovation, understands the value of non dilutive capital for startups and growing tech companies. Our commitment to providing tech CEOs with the tools and knowledge they need to succeed includes guidance on securing non dilutive funding. We believe that preserving ownership and control while accessing the necessary funds is key to driving the tech industry forward.

Key Insights on Non Dilutive Capital

To make the most of non dilutive capital, tech CEOs must grasp the diverse funding sources available and how best to utilize them. These sources include government grants, R&D tax credits, loans, revenue-based financing, venture debt, and crowdfunding. Each source offers unique advantages, such as flexible repayment terms and faster approval processes compared to traditional bank loans.

In conclusion, non dilutive capital is an invaluable resource for tech CEOs seeking growth and innovation without sacrificing ownership and control. It allows tech companies to secure the funds they need quickly and efficiently. By understanding the nuances of non dilutive capital, tech CEOs can empower their ventures for long-term success in the dynamic world of technology.

In the world of tech startups, securing the necessary capital to fuel growth and innovation is often a top priority. However, traditional funding routes, such as equity financing, can come at a significant cost – the dilution of ownership and control. That's where non dilutive capital steps in as a compelling and strategic alternative. Understanding…